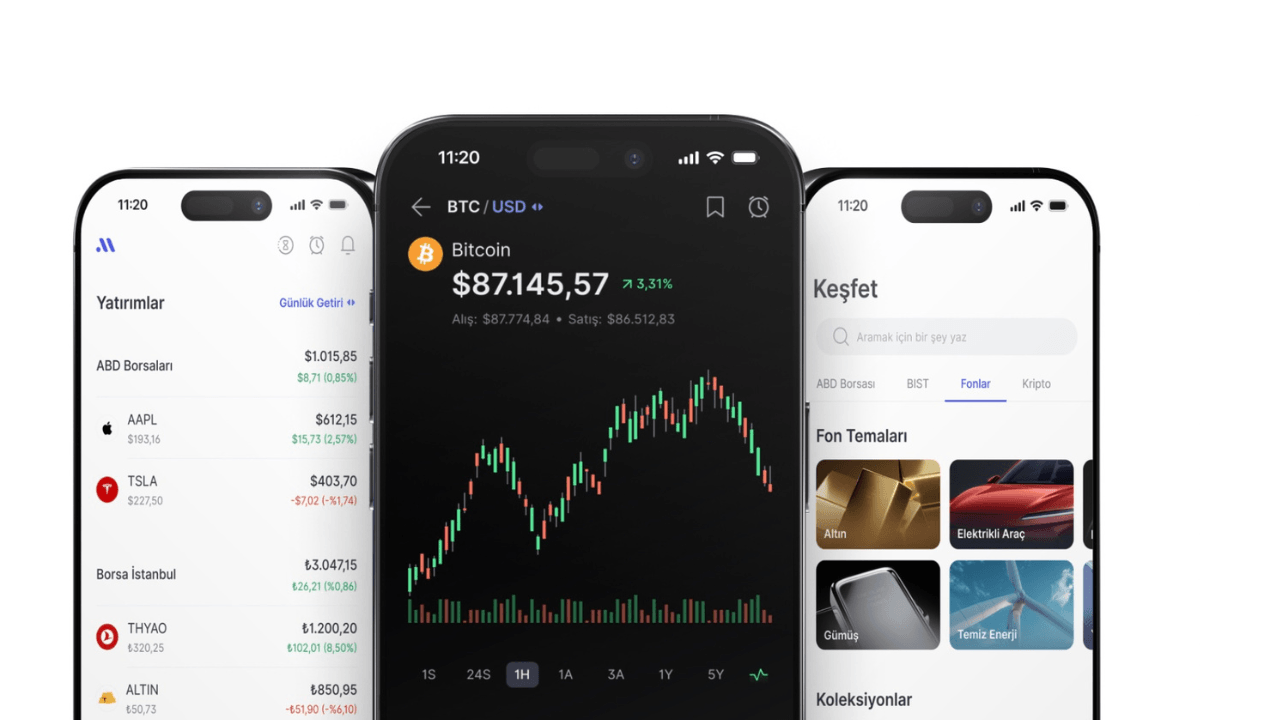

Midas, Turkey’s top investment platform, has secured $80 million in Series B funding, marking the largest-ever investment for a Turkish fintech. This raises Midas’ total funding to over $140 million. Founded in 2020, Midas allows users to invest in Turkish and US equities, mutual funds, and cryptocurrencies via a single platform. Midas has rapidly expanded to serve more than 3.5 million investors, offering US exchange trading for a flat $1.50 fee per transaction and eliminating all commissions and account-related fees on Borsa Istanbul. The platform provides free real-time market data.

Since its inception, Midas has transformed access to financial markets in Turkey, providing a commission-free, seamless experience. Millions have made their first investments through Midas, saving nearly $50 million in fees, with half starting their investing on the platform. Midas set new standards by drastically reducing costs, cutting US trading fees by 90%, and removing Borsa Istanbul commissions in 2025. Today, it offers free live market data and instant, fee-free transfers, becoming a leading choice for Turkish retail investors.

CEO Egem Eraslan stated that Midas’ mission is to make investing accessible, affordable, and seamless for all. With the new funding, Midas aims to build a comprehensive ecosystem that unifies investment needs, while enhancing security and technology infrastructure to support growth in Turkey and globally.

The significant funding demonstrates international confidence in Midas’ role in reshaping Turkey’s fintech scene. The round was led by QED Investors, with new investors including the International Finance Corporation, HSG, QuantumLight, Spice Expeditions LP, and George Rzepecki. Existing supporters Spark Capital, Portage Ventures, Bek Ventures, and Nigel Morris also participated.

Yusuf Özdalga of QED Investors highlighted Midas’ access to domestic and global opportunities for Turkish investors through advanced fintech tools and expressed excitement about the partnership with Midas.

Midas has democratized investing and is now developing tools for sophisticated investors. Following the launch of margin investing, advanced analytics, and Midas Pro, the Series B funding will introduce derivatives trading in Turkish and US equities. The rollout begins in September with US options trading, offering free real-time data, competitive pricing, and user-friendly interfaces.

Meanwhile, Midas is boosting its security and operational resilience to global standards, with the new funds enhancing security infrastructure and accelerating the launch of advanced products for active traders.