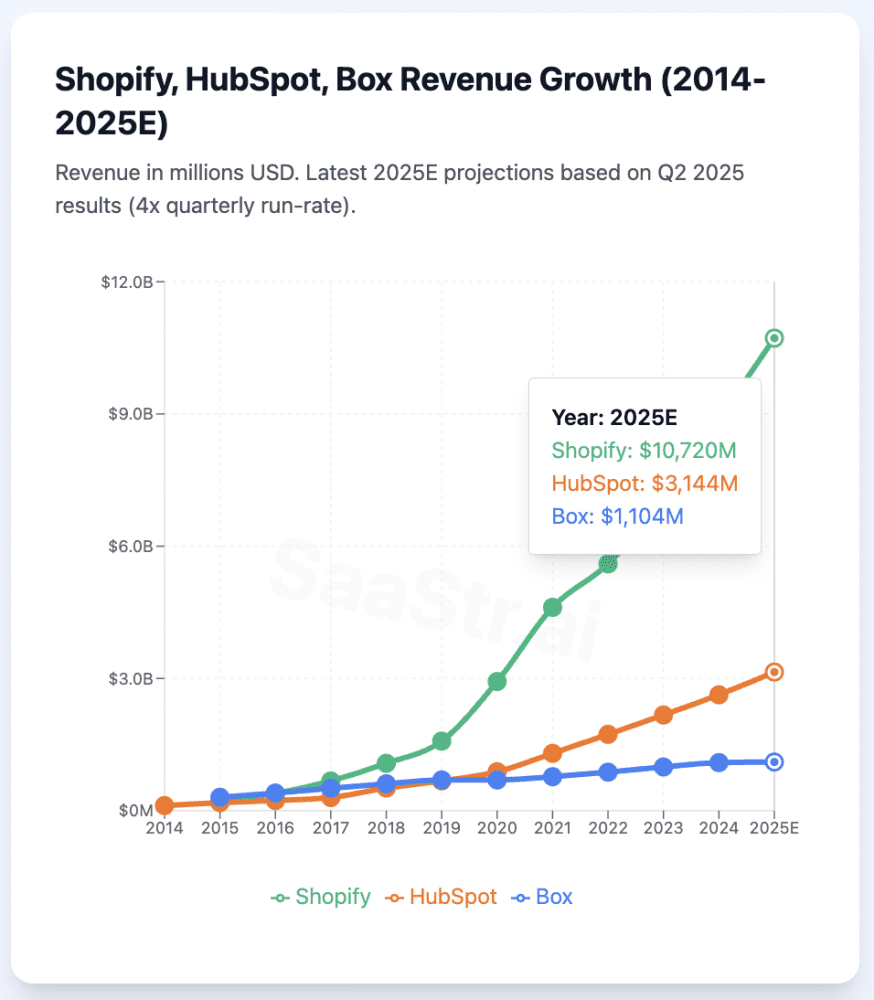

Shopify’s $10.7B ARR vs. HubSpot’s $3.1B ARR vs. Box’s $1.1B ARR: How Three 2014-2015 IPOs Delivered Wildly Different Revenue Outcomes Over Time

A decade-long analysis reveals why market timing and positioning drove 52x, 27x, and 3.6x revenue growth

—

### The Setup: Three Companies, One Era, Vastly Different Revenue Destinies

In the mid-2010s, three promising SaaS companies went public within months of each other. HubSpot debuted on the NYSE in October 2014 at $25/share with $116M in annual revenue. Shopify followed in May 2015 at $17/share with $205M in revenue. Box completed the trio in January 2015 at $14/share with $303M in revenue.

All three had compelling stories, strong founding teams, and seemed positioned for SaaS success. Fast-forward to Q2 2025, and the revenue divergence is staggering.

### The Numbers: A 52x vs. 27x vs. 3.6x Revenue Story

**Shopify (SHOP):** From $205M (2015) → $10.7B projected (2025E) = **52x revenue growth**

– Q2 2025: $2.68B revenue (+31% YoY)

– Net income surged 429.8% to $906M

– Europe GMV growth: 42% year-over-year

**HubSpot (HUBS):** From $116M (2014) → $3.1B projected (2025E) = **27x revenue growth**

– Q2 2025: $761M revenue (+19% YoY)

– Added 9,700+ net customers in quarter

– 268K total customers globally

– 97.9% of revenue from subscriptions

**Box (BOX):** From $303M (2015) → $1.1B projected (2025E) = **3.6x revenue growth**

– Q1 FY26: $276M revenue (+4% YoY, +5% constant currency)

– Billings growth of 27% YoY

– Remaining performance obligations up 21% to $1.47B

These represent different business trajectories that every SaaS founder should understand.

—

### What Drove These Radically Different Revenue Outcomes?

#### 1. **Market Timing Drives Everything in SaaS**

– **Shopify** captured the e-commerce inflection point and benefited significantly during the COVID-19 pandemic.

– **HubSpot** was at the forefront of the digital marketing revolution with their inbound marketing methodology.

– **Box** faced tough competition from larger tech companies commoditizing cloud storage.

#### 2. **Category Creation Beats Feature Competition Every Time**

– **Shopify** defined the “commerce operating system” category.

– **HubSpot** created “inbound marketing” and built a strong community and methodology around it.

– **Box** remained within the commoditized “file storage” category.

#### 3. **Platform Effects Create Exponential Revenue Growth**

– **Shopify’s** app ecosystem creates compounding platform effects.

– **HubSpot** built a similar ecosystem with a CRM and marketing platform.

– **Box** never achieved the same platform dynamics.

#### 4. **TAM Expansion Drives Multiple Expansion**

– **Shopify** expanded from small businesses to enterprise.

– **HubSpot** expanded from marketing to sales, service, CMS, and Revenue Operations.

– **Box** remains primarily known for file storage and security.

—

### The AI Inflection Point: A New Chapter in Revenue Divergence

#### **Shopify’s AI Acceleration**

AI-powered tools are driving current growth, attracting enterprise customers like Starbucks.

#### **HubSpot’s AI-First Transformation**

CEO Yamini Rangan aims for HubSpot to be the leading AI-first customer platform.

#### **Box’s Intelligent Content Bet**

Box is focusing on “Intelligent Content Management” with AI, but they’re still catching up.

—

### The Revenue Architecture Lessons for Every B2B Founder

#### **Lesson 1: Choose Your Market Timing Carefully**

Market timing can create significant differences in outcomes.

#### **Lesson 2: Category Creation > Feature Competition**

Innovate by creating new categories for defensibility.

#### **Lesson 3: Platform Effects Compound Revenue Growth**

Platforms with an ecosystem have compounding growth benefits.

#### **Lesson 4: Plan for TAM Expansion from Day One**

Continuously expand addressable markets.

#### **Lesson 5: Recurring Revenue Quality Varies Dramatically**

Different subscription models have varied unit economics and growth potential.

—

### What 2025 Earnings Tell Us About the Future

– **Shopify**