Could Databricks at $100B Be … Cheap? A Deep Dive into Data Analytics Valuations

Databricks and Snowflake both have around $4B in ARR, but Databricks is growing at double the rate (50% vs 26%). Considering growth rates and AI positioning, Databricks’ $100B valuation might offer attractive value relative to Snowflake’s public market pricing ($65B at the time).

The Setup: A Tale of Two Data Giants

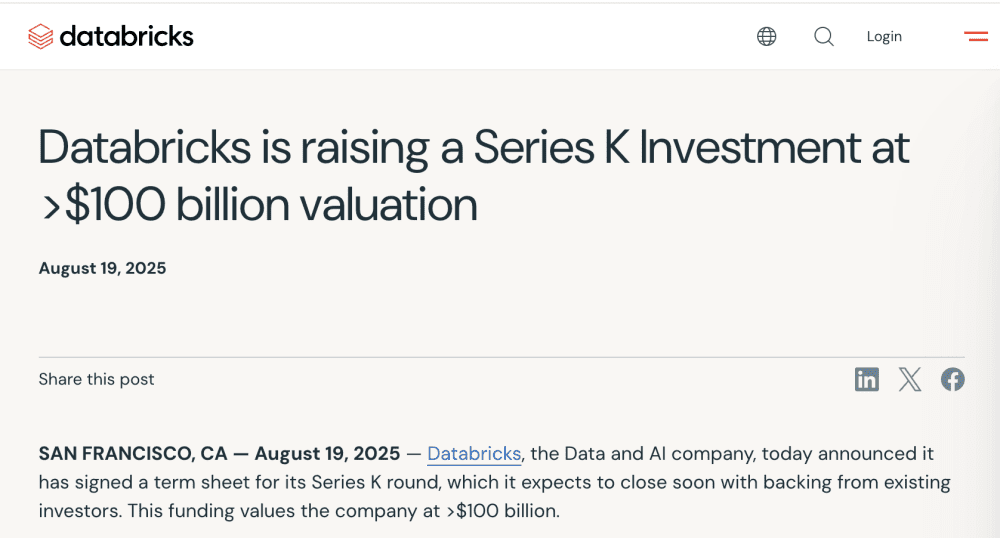

The data analytics world saw a major event as Databricks announced Series K funding at a $100 billion valuation, up 61% from December’s $62 billion round. Its annualized revenue reached $3.7 billion by July 2025, showing a 50% year-over-year growth rate.

Snowflake, a key public market competitor, trades at about $66.5 billion with $3.84 billion in trailing twelve-month revenue. Yet, the valuation calculations reveal more than the headlines suggest.

The Numbers: Head-to-Head Comparison

While Databricks has a 56% valuation premium, it grows 92% faster than Snowflake. After adjusting for growth rates, Databricks seems 19% cheaper on a growth-adjusted basis.

The Growth Premium: Why Speed Matters in Data

Databricks is growing at nearly twice Snowflake’s rate (50% vs 26%). Using a growth-adjusted multiple, Databricks trades at 0.54x its growth rate, while Snowflake trades at 0.67x, making Databricks appear as the bargain.

The AI Multiplier Effect

It’s beyond data warehousing; it’s about becoming the foundation for enterprise AI. Databricks has made strategic moves positioning it at the core of the AI revolution:

Recent Strategic Moves:

- $1 billion acquisition of Neon

- Launch of Lakebase database

- Agent Bricks for AI development

- 15,000+ enterprise customers, with over 50 spending more than $10M annually

The company is building the infrastructure powering AI transformations across enterprises, making premium valuations logical.

The Customer Economics Story

Databricks’ customer metrics highlight a strong retention and expansion story:

- Net retention rate over 140%

- 50 customers spending more than $10M annually

- Enterprise customer concentration driving revenue quality

Compared to typical B2B benchmarks, Databricks’ growth shows profitable, sticky growth.

The Competitive Positioning Advantage

While Snowflake pioneered cloud data warehousing, Databricks is defining the next generation with unified analytics combining data engineering, science, and machine learning. The lakehouse architecture shifts towards more flexible, cost-effective data infrastructure.

Key Differentiators:

- Unified platform

- AI-native architecture

- Open-source foundation

- Multi-cloud strategy

This becomes crucial as enterprises seek comprehensive AI-powered analytics workflows.

Sector Dynamics: Rising Tide Lifts All Boats

The data analytics sector sees unprecedented demand. Enterprise data volumes grow, regulatory requirements tighten, and AI adoption increases, creating a huge market with room for multiple winners.

Market Tailwinds:

- AI adoption driving higher data infrastructure needs

- Regulatory compliance needing better data governance

- Accelerating digital transformation

- Standardization of multi-cloud strategies

Valuation Risk Factors

No valuation analysis is complete without discussing the risks:

Execution Risks:

- Maintaining 50% growth rates at scale is challenging

- Competition from major cloud providers

Market Risks:

- AI hype potentially lowering short-term expectations

- Customer concentration risks in enterprise segments

The IPO Timeline Question

C