A new report reveals the extent of financial exclusion for people with learning disabilities, highlighting that over a third need continuous help with daily expenses, and nearly one third don’t have a bank account in their name. These figures point to systemic barriers such as complex sign-up processes, inaccessible digital tools, and insufficient personalized support, leaving many marginalized and vulnerable.

In response, CI&T introduced Nemo, Art of the Possible, a pioneering financial app prototype developed in partnership with Project Nemo, an initiative promoting disability inclusion in Fintech and Financial Services.

I spoke with Hannah Darley, Senior Strategy Director at CI&T, to understand how tech companies can integrate inclusive practices into their design processes.

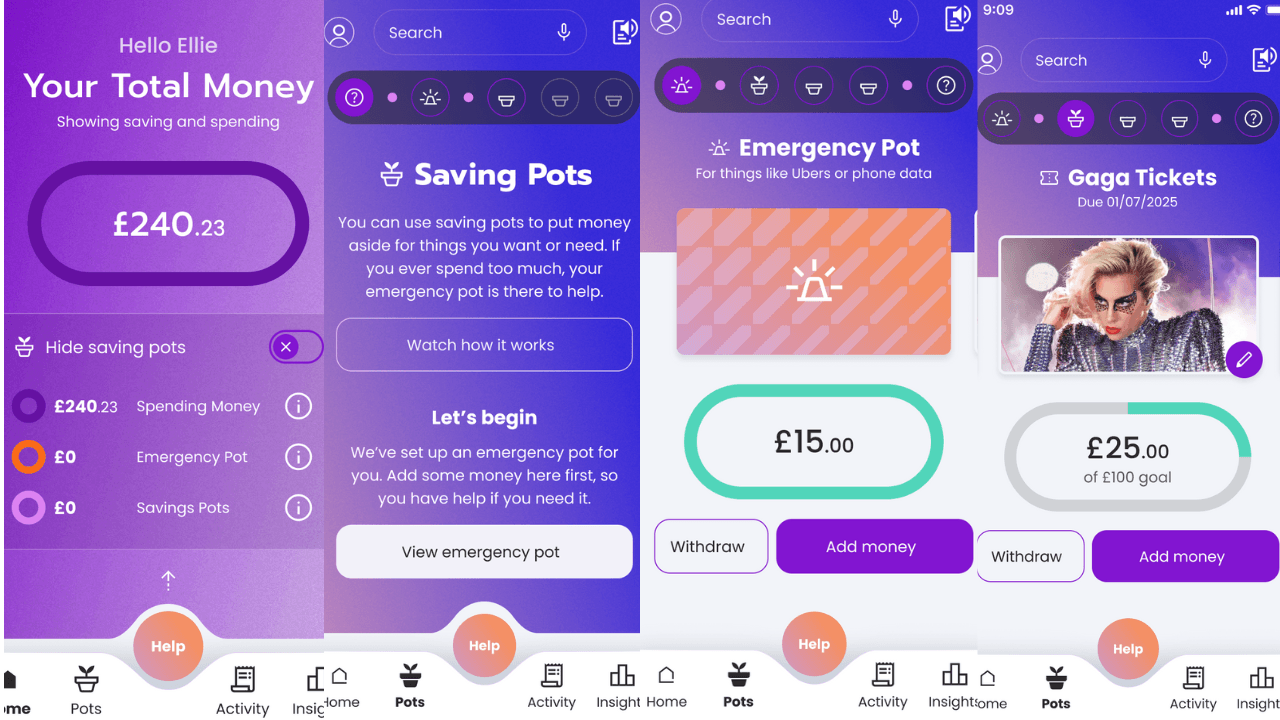

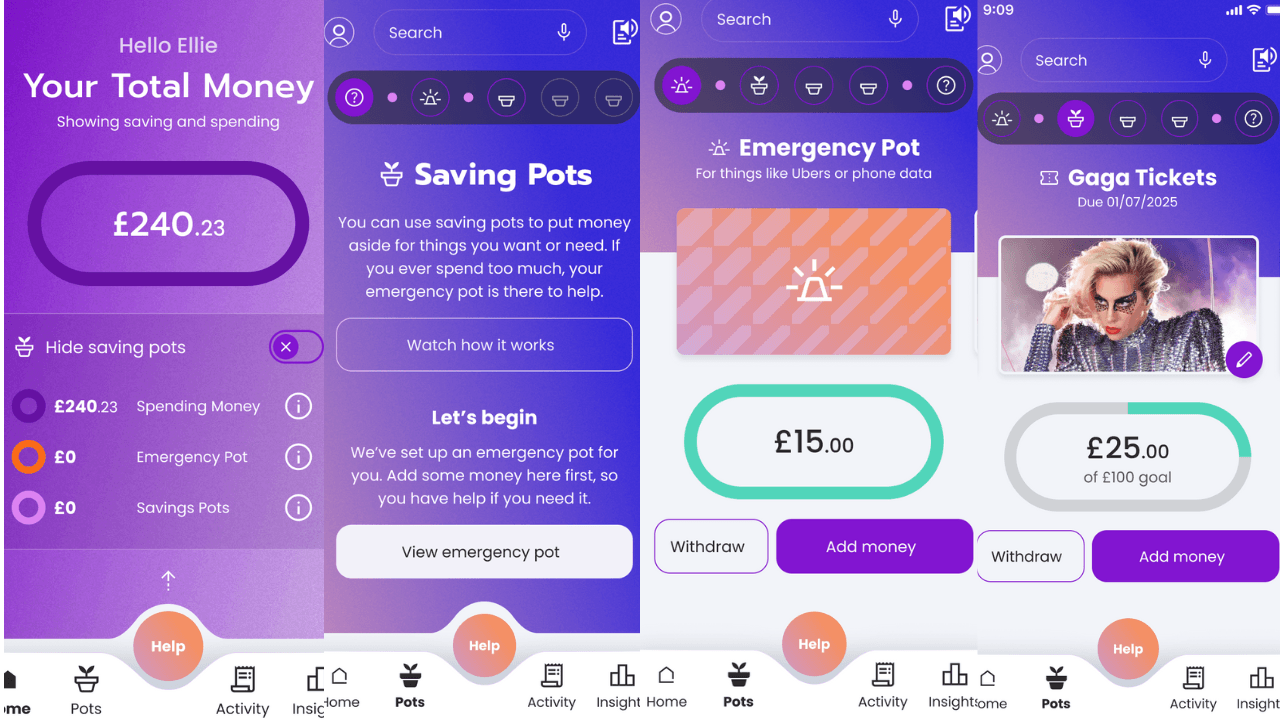

The Nemo prototype is designed for adults with learning disabilities to manage finances independently and safely, and it serves as a model for startups to create user-centric tech that exemplifies inclusive design.

Created in just six weeks, CI&T worked alongside individuals with lived experiences to develop an app that directly tackles banking challenges faced by them.

Transforming Inclusive Banking Challenges into Action

The app is part of a larger plan that began with a roundtable at Nationwide discussing banking issues for people with learning disabilities, resulting in four areas of focus:

- A significant research project funded by Nationwide and executed by Firefish, examining the banking experiences of people with learning disabilities.

- A regulatory review by Fox Williams, evaluating frameworks like the Mental Capacity Act.

- A solutions review, looking at current and emerging tools.

Finally, “The Art of the Possible”, where CI&T collaborated.

Authentic User-Centric Design From the Beginning

In crafting the app, the team began with a clean slate. Alongside the research, they included people with lived experiences — individuals with learning disabilities and their caregivers — from the start.

This involvement was critical. Past examples show startups failing by not testing their products with actual users, highlighting the importance of continuous engagement with the target group.

“We had a kickoff workshop with Project Nemo volunteers, industry experts, people with lived experience, and caregivers, and that involvement continued throughout the project.”

“Here, people with lived experience were embedded throughout.”

Many expressed: ‘This is the first time we’re really being heard.’ Often, decisions are made about them, not with them. That ongoing involvement was immensely valuable.”

Identify Your Users’ Key Challenges

Project Nemo excelled in its approach. Darley shared:

“The difference in working with people with learning disabilities and caregivers was not who was involved, but how often.”

The team working on Nemo recognized the specific needs of users with disabilities:

- Opening an account: Documentation requirements pose challenges.

- Ongoing money management: A third of people need regular support.

- Unsafe methods: Many share cards or passwords with caregivers, posing risks.

- Fraud and exploitation: They are often targeted or enlisted in agreements they don’t understand fully.

- Banking apps: Remembering PINs, navigating apps, or dealing with declined transactions causes stress.

Additionally, existing “parent-child” financial tools often feel patronizing to adults with learning disabilities.

Develop Rapid, User-Focused Designs That Adapt

Joanne Dewar, Founder of Project Nemo, sought a neutral partner to prioritize user needs without constraints, creating a template adaptable by any bank or fintech globally.

The process began broadly, identifying functional, emotional, and physical needs for a money management app. It then focused on one persona: Emily and her daughter Ellie, who has Down syndrome.

The team developed a high-fidelity prototype and technical proof of concept in just six weeks, showing that 86% of features could be implemented with current technology, resulting in a live prototype shaped by lived experience. This showcases how inclusive design can lead to scalable solutions for immediate implementation by the finance sector. Darley stated: