Roadsurfer, a Munich-based outdoor mobility company, has secured €25 million to boost the international growth of its camper van rental platform across Europe and North America. The funding came through a venture debt transaction from BBVA, with support from the European Investment Fund (EIF) under the InvestEU program.

“These financing rounds reflect our partners’ confidence in our business model. The collaboration with BBVA was marked by constructive dialogue and a shared understanding of long-term value creation,” stated Markus Dickhardt, Co-founder and CEO of Roadsurfer.

Founded in 2016 by Markus Dickhardt, Stephie Niemann, Christoph Niemann, Jean-Marie Klein, and Susanne Dickhardt, Roadsurfer has become a leading brand in the camper van rental industry. It has a fleet of nearly 10,000 vehicles and operates in over 90 locations across 16 countries, including Germany, Spain, France, Portugal, the U.S., and Canada.

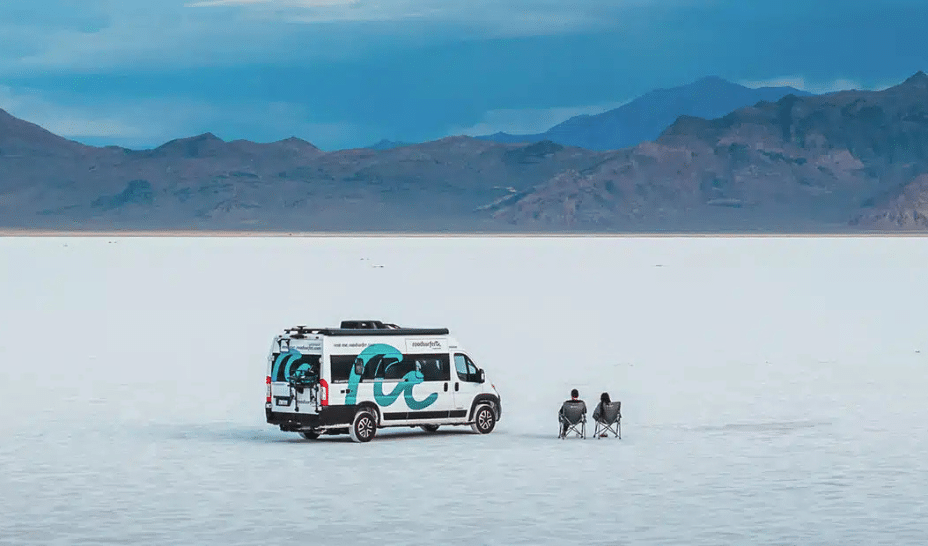

The company offers rental, subscription, and sales services for camper vans, along with the “roadsurfer Spots” platform that connects travelers with private landowners for camping.

In 2023, Roadsurfer achieved sales of around €114 million with an annual profit of approximately €1.6 million. The BBVA financing complements a previous €60 million asset-backed securitization (ABS) led by Macquarie Group, raising Roadsurfer’s total financing capacity to over €500 million.

These transactions highlight the company’s capital strategy aimed at strengthening its fleet, consolidating key markets, and developing digital solutions to make camper travel more accessible, sustainable, and appealing.

“Roadsurfer represents the type of exciting high-growth company backed by top-tier VCs that BBVA wants to support: digital, innovative in their space with an incredibly strong management team and committed to fostering more sustainable ways of traveling. Its growth reflects the dynamism of the European entrepreneurial ecosystem and our commitment to providing flexible financial solutions to international companies with proven global ambitions,” said Donatella Callegaris, Head of Venture & Growth Lending at BBVA in Europe.

This follows a €30 million investment from Avellinia Capital in February 2025 as part of an asset-backed financing.