Ten years ago, Europe’s venture capital scene was still developing, often overshadowed by Silicon Valley and China. Now, according to the latest Invest Europe report, it has made significant strides: €143 billion has been invested in over 26,000 startups, creating a million new jobs and fostering a strong sense of optimism around local innovation.

For those working within the industry, these changes reflect more than numbers. At Zubr Capital, a European growth and private equity fund specializing in scaling innovative businesses, we’ve seen firsthand the transformation of the landscape. This achievement led us to explore the true changes in European VC and its future direction.

What fuels European VC now that initial excitement has waned? While figures are part of the narrative, so are changes in focus, the types of ventures receiving investments, and the balance of challenges and opportunities. We sought to dissect the trends, the momentum, and future potential.

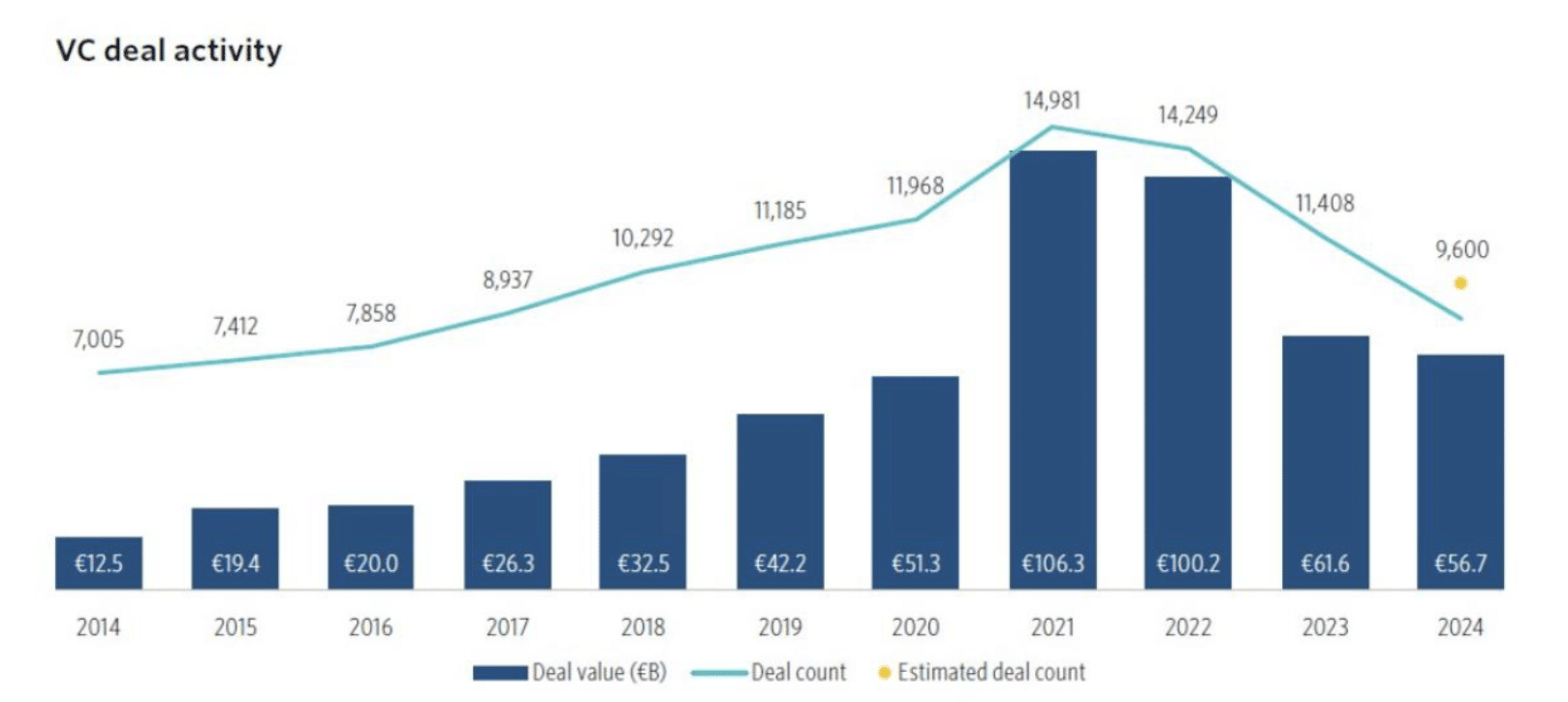

You can’t overlook the progress of the European VC market over the past decade. In 2015, investments amounted to around $15 billion. By 2021, this figure exceeded $100 billion, driven by large late-stage deals and fresh influxes from global investors. Though things have cooled, with 2023 funding at about $45 billion, it’s still a significant leap from pre-pandemic levels.

European startups raised over $420 billion in the past decade. This is about more than bigger sums. Europe’s share of global venture capital rose from 13% in 2014 to a peak of 18% in 2021, currently around 15% in early 2025. The US market remains larger, but Europe has found its footing—even amidst downturns—by building resilience and setting a more stable foundation for future growth. What’s considered “normal” today would have seemed unattainable a decade ago.

It’s not just about more money; it’s about investment direction. Fintech once dominated, but climate tech is now in focus. In 2023, climate and green technologies accounted for about 27% of European VC investment, doubling their share from two years prior. This shift includes sectors like battery tech and hydrogen energy attracting significant funding.

AI is another highlight. Even as total investment declined in 2023, AI funding hit new highs in 2024, particularly within generative AI and automation, continuing to grow into 2025 according to recent reports.

Health and biotech remain pertinent, bolstered by Europe’s strong research and life sciences sectors, underscored by the pandemic. Traditional sectors like B2B software and SaaS are seeing a decline as investors pivot towards deep tech and infrastructure. Europe now leads globally in climate tech, forging its identity in AI and industrial innovation.

Historically, the “big three”—the UK, France, and Germany—dominated Europe’s startup scene. London especially attracts substantial VC funding. However, the landscape is evolving. France’s venture market is growing rapidly, rivaling Germany in capital raised and leading in new company formation.

Remarkably, innovation is now widespread beyond traditional hotspots. The Netherlands, Sweden, and Switzerland have strong ecosystems, and smaller nations like Estonia and Ireland boast more unicorns per capita than larger neighbors. Nearly thirty European countries boast at least one billion-dollar company. In short, innovation thrives beyond a few capitals, rendering Europe’s startup map broad, active, and unpredictable.

The startup boom didn’t just create more companies; it changed their success pathways. Post-COVID, there was a surge of IPOs, acquisitions, and record deals, peaking in 2021. However, the IPO market slowed in 2022 and 2023, and exit values decreased. Companies are opting to wait, favoring mergers, acquisitions, and private funding as preferred routes for now.

This slowdown has made investors patient for returns but left a backlog of mature companies ready to go public when markets rebound. Currently, over a hundred European tech firms are IPO-ready, gearing up for what’s next. Exits require patience, strategic M&A, and an anticipation for the next IPO surge.

A standout feature of Europe’s VC market is the significance of public money. While private investors are crucial, government-backed funds like the European Investment Fund and national development banks often serve as anchors. In 2023, close to 40% of VC capital came from government sources, up significantly from the previous year.

This support has kept the ecosystem stable, even as some private funds withdrew. Early-stage startups continue finding support, yet there’s an ongoing discourse on attracting more private institutional capital, such as pension and insurance funds. While the market is trending in that direction, strong public involvement remains beneficial, offering resilience and a long-term vision.

Following a decade of growth and change, Europe’s venture capital market has transformed. Investment levels remain high, and startup creation is robust. In key sectors like AI, deep tech, and climate tech, Europe takes the lead.

The future isn’t solely about finances. Building a