TL;DR: Figma’s $1.2 billion IPO, initially valued at $19.3 billion and skyrocketing to $47.1 billion by day end, stands as one of the most triumphant tech IPOs in recent years, eclipsing most significant offerings since 2020 both fundamentally and in market response.

A Benchmark for Success

Figma shines even compared to recent high-growth IPOs like Circle and CoreWeave, with nearly 50% year-over-year revenue growth and Q1 profitability. While 2020’s IPOs raised more money, Figma sets the gold standard for B2B companies entering public markets in 2025 with its combination of scale, profitability, and outstanding first-day performance.

Figma: A Lesson in B2B IPO Excellence

Key Figures:

– $749 million revenue in 2024 (48% YoY growth), $1B ARR present

– 91% gross margin with $821 million in rolling 12-month revenue

– Q1 2025 net income of $44.9 million – profitability at scale

– Over 13 million monthly users, only a third are designers

– Approximately 450,000 customers as of March 31

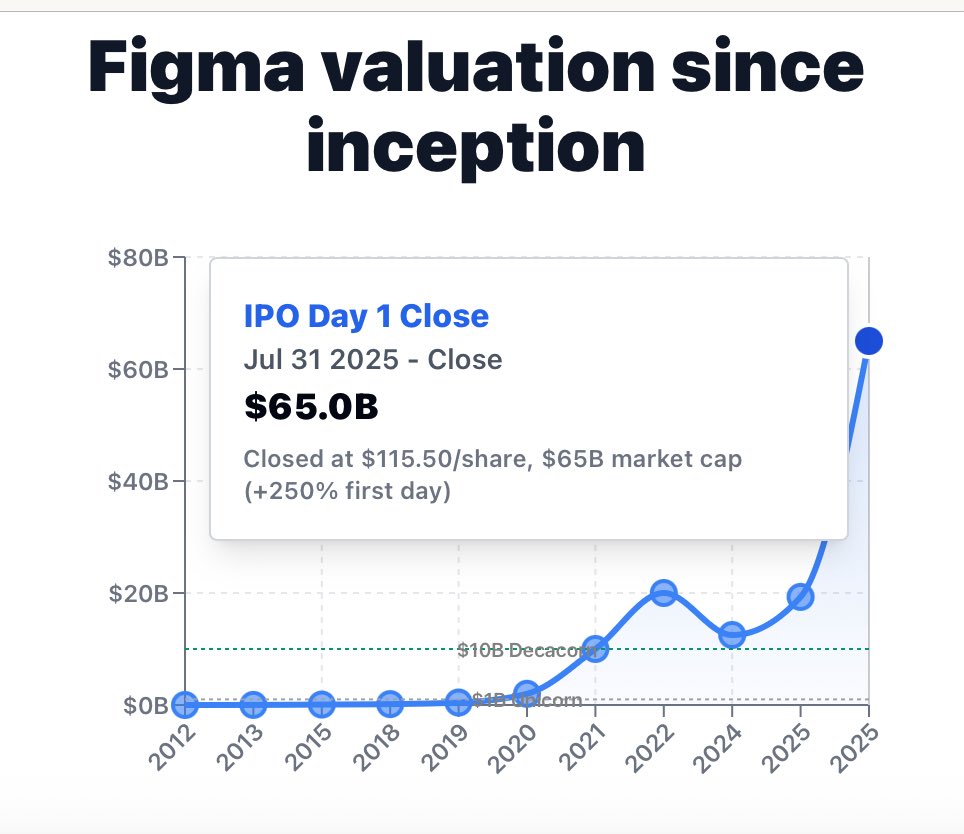

IPO Highlights:

– Priced at $33 per share (above the initial $25-$28 range)

– Started at $85, peaked at $124.63 intraday, closed at $115.50

– 250% first-day increase from offer price

– Market cap leaped from $19.3 billion to $47.1 billion

Comparing to the 2020 Tech IPO Giants

The 2020 Leaders: Snowflake, Airbnb, DoorDash

Snowflake (September 2020):

– Raised $3.9 billion, the largest software IPO then

– Valued at $33 billion before trading, more than doubled first day

– Slightly outperformed Nasdaq post-initial surge

Airbnb (December 2020):

– Raised $3.4 billion at $47.3 billion valuation

– 112% first-day surge

– Less than 3% up post-first day at reporting time

DoorDash (December 2020):

– Priced at $102, opened at $182, 85% first-day gain

– Post-initial surge investors suffered losses

The Key Difference: All 2020 mega IPOs, including 2019’s Uber/Lyft, relied heavily on external capital for growth, with only Airbnb recording net profit in recent reports after cutting costs. Figma achieved profitability while growing 48% YoY – a completely different pathway.

AI Stars of 2025: CoreWeave and Circle

CoreWeave (March 2025):

– Priced below expectations at $40 per share ($20 billion valuation)

– Increased 270% since IPO

– $981.6 million revenue (420% growth) but $314.6 million net loss

– 77% of revenue from two customers, with Microsoft at 62%

Circle (June 2025):

– Stock soared 500% post-debut

– Raised $1.05 billion

What Distinguishes Figma’s IPO

1. True SaaS Economics at Scale