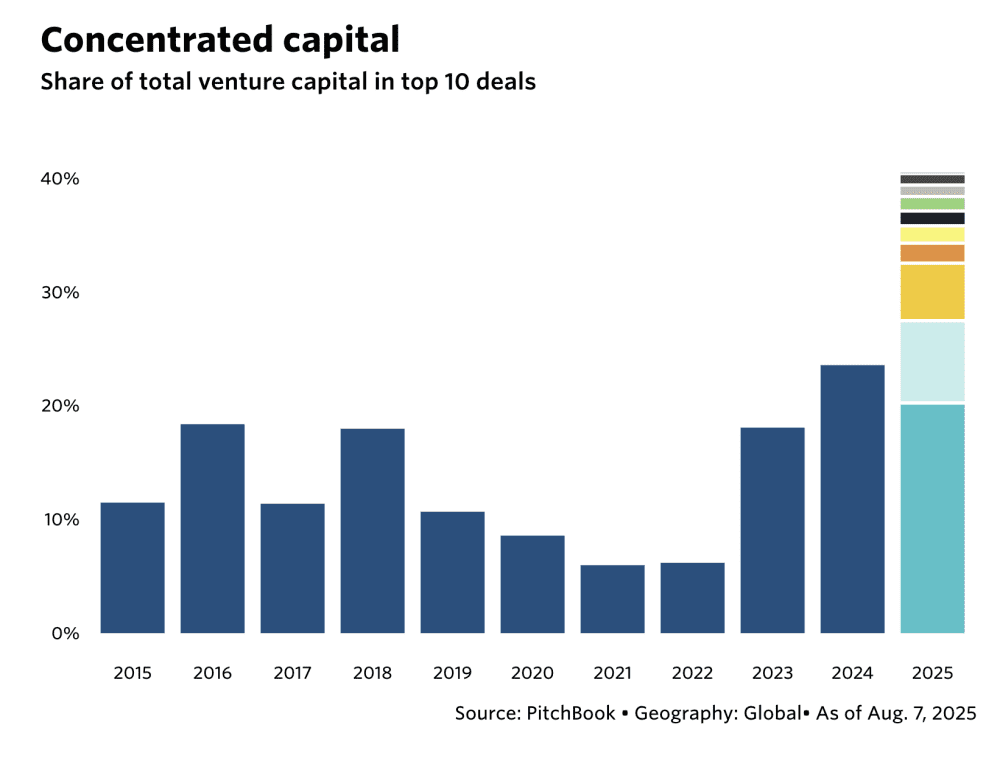

Current trends in venture capital reveal a stark reality: if you’re not among the elite few, you’re vying for leftovers. The AI era has not only led to huge funding rounds but also directed those funds to the smallest number of companies ever. According to Pitchbook, 41% of this year’s U.S. venture capital has been funneled into just 10 companies. That’s a shocking concentration among thousands seeking investment.

This signals not just concentration but a fundamental change in venture capital operations.

Key Numbers Founders Must Consider

Here’s what 41% concentration looks like:

- $81.3 billion was allocated to only 10 startups out of a total $197.2 billion in VC deployments in 2025

- A 75% increase from the share given to the top 10 companies in 2024

- The highest concentration in a decade

- Eight of these ten are AI-centric

Consider this: OpenAI’s $40 billion raise was the largest single financing event in venture capital history, exceeding many entire years of past VC activity.

The leading three AI firms (OpenAI, xAI, Anthropic) secured $65 billion, nearly one-third of this year’s venture funds.

Why The Concentration Is Growing

1. AI Infrastructure Needs Massive Capital

Frontier AI development requires billions for tasks like training large models and acquiring talent, altering the dynamics from previous tech cycles where millions sufficed.

Scale AI’s $14.3 billion round from Meta (with Meta acquiring a 49% non-voting stake) illustrates today’s scale needs, highlighting a shift to a different level of investment.

2. The Power Law Has Intensified

Venture capital historically thrived on power law dynamics, with a few big wins covering losses. Now, the market is split:

- Mega-funds manage billions in assets, focusing on mega-deals

- Boutique funds contend over the residual 59% of capital across many companies

- New fund managers raised a mere $1.8 billion across 44 funds, far less than Founders Fund’s $4.6 billion

3. Corporate Venture Arms Increase Concentration

Tech giants drive investments with strategic moves that reshape markets:

- Microsoft’s OpenAI partnership includes integration and cloud infrastructure

- Amazon’s $8 billion Anthropic investment positions AWS as key cloud provider

- Meta’s Scale AI acquisition places CEO Alexandr Wang to helm Meta’s new Superintelligence Lab

These are not typical VC stakes but strategic acquisitions masquerading as funding rounds.

The Difficult Reality for Others

Seed Funding Is Declining

Despite the funding surge, seed funding dropped 14% year-over-year to $7.2 billion in Q1 2025, with early-stage investment falling to $24 billion, its lowest in at least five quarters.

Deal Count Keeps Dropping

Global deal numbers have decreased for four consecutive quarters, down 28% year-over-year. Fewer companies receive funding, yet those who do secure large amounts.

Fundraising Timelines Are Prolonging

The average time to raise a venture fund hit a record 15.3 months in 2025. For those not in mega-funds, raising capital is increasingly difficult.

Implications for Key Players

For VCs: Choose Your Strategy Wisely

Venture capital is splitting into two distinct paths:

Mega-Funds ($1B+ AUM):

- Target late-stage, proven companies

- Deal sizes average $200M+

- Focus on 10-20 investments per fund

- Depend on billion-dollar exits to make an impact

Niche